FiveThirtyEight has released a new data visualization tool which allows you to see the lasting effects of redlining on American towns & cities. In the 1930s, under President Franklin D. Roosevelt's New Deal, black homeowners across the United States were discriminated against through the creation of redlining maps. These maps identified areas with significant black populations and labeled them as too high risk for mortgage support. Black homeowners living in these areas were therefore very unlikely to be successful when trying to refinance home mortgages from the government sponsored Home Owners' Loan Corporation.

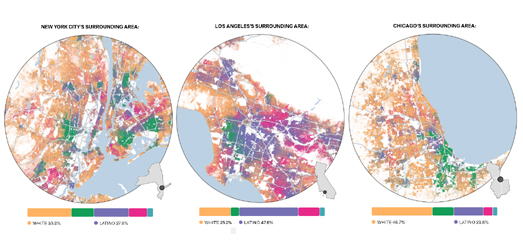

It is now over eighty years since neighborhoods in American towns & cities were designated by the HOLC as 'best', 'desirable', 'declining' or 'hazardous'. Despite this long passage of time the effects of redlining are still apparent in the continuing segregation of American cities. In The Lasting Legacy of Redlining FiveThirtyEight allows you to explore maps which show the racial segregation of American cities based on data from the 2020 U.S. decennial census.

For each city you can select to view maps of the HOLC zones ('best', 'desirable', 'declining' or 'hazardous') alongside a breakdown of the percentage of each racial group now living in each of these zones. For example the map of Cleveland shows that 59.5% of the population of the city's 'hazardous' designated zones is black. While the city's 'best' zones have a 68.7% white population.

It is clear that the racial discriminatory mortgage assessments of the 1930s have had a lasting legacy on American cities. A legacy which can still be felt in the United States today. Neighborhoods which were redlined as too high risk for mortgage lending in the 1930s have suffered from decades of under-investment in critical infrastructure. This historical under-investment means that anyone living in a once redlined neighborhood today is still likely to have less access to health care, be more at risk from extreme summer heat and is even at more risk of flooding than people living in neighborhoods which weren't redlined under Roosevelt's New Deal.

Bloomberg's Redlined, Now Flooding compares historical redlining maps with modern flood risk maps. This comparison reveals that in cities across the United States there is a greater risk of flooding in formerly redlined neighborhoods than in more affluent neighborhoods in the same city.

Redlined neighborhoods don't just face a greater risk of flooding. Since the New Deal's racially discriminated mortgage lending assessments of American cities redlined neighborhoods have continued to face under investment in infrastructure compared to their more wealthy greenlined neighborhoods. In How Decades of Racist Housing Policy Left Neighborhoods Sweltering the NYT shows how across the United States neighborhoods which were redlined are now more likely to suffer from the urban heat island effect than neighborhoods which weren't redlined.

The legacy of the Home Owners' Loan Corporation (HOLC) redlining maps can also still be seen in the health inequality in cities today. The Digital Scholarship Lab and the National Community Reinvestment Coalition has used maps to show how redlined neighborhoods suffer severe health disparities in the 21st Century compared to more wealthy neighborhoods.Not Even Past: Social Vulnerability and the Legacy of Redlining allows you to directly compare redlining maps with modern maps which visualize the modern health disparities in U.S. cities.

Of course one of the biggest lasting legacies of redlining has been the continuing racial segregation seen in many American cities. Wenfei Xu's Redlining Mapvisualization (like FiveThirtyEight's) allows you to explore for yourself if the HOLC redlining maps have had a lasting impact on segregation in your city. Using modern census data alongside the HOLC redlining maps you can see for yourself which neighborhoods have a high percentage of black, white or Hispanic people and see if these areas correlate with areas which were deemed at risk or safe for lending purposes in the 1930's.

No comments:

Post a Comment